Innovation needs to be accompanied by a culture of adopting innovation

For much of the 20th century, Eastman Kodak was a dominant force in the film photography business. In 1976, the company accounted for ~90% of film and 85% of camera sales in the United States. Eastman was a believer in blue sky research, this emphasis allowed Kodak to pivot multiple times at crucial strategic points throughout its history: from dry plates to film, and from black and white to color.

How then, did the photography juggernaut that coined the phrase “Kodak moment” suffer such a monumental fall from grace, going from a $30 billion market cap in 1990 to bankruptcy just years later?

Ironically, the innovation that would eventually topple Kodak’s empire came from its own R&D labs. In 1975, Kodak engineer Steve Sasson invented the first digital camera. Despite cultivating the talent and funding required to produce such a breakthrough, Kodak viewed digital photography as too much of a threat to their core business (film) and stifled its potential themselves.

As shown by many other examples, a culture of unrelenting innovation was not enough to guarantee the long-term survival of Kodak. Ultimately, flawed assumptions and self-imposed myopia would prevent Kodak from realizing the potential of its own invention, stopping them from making the necessary changes to compete.

Innovation needs to be accompanied by a culture of embracing and adopting innovation, constantly changing assumptions in light of new information.

Many of the Current Blockchain Assumptions are Flawed

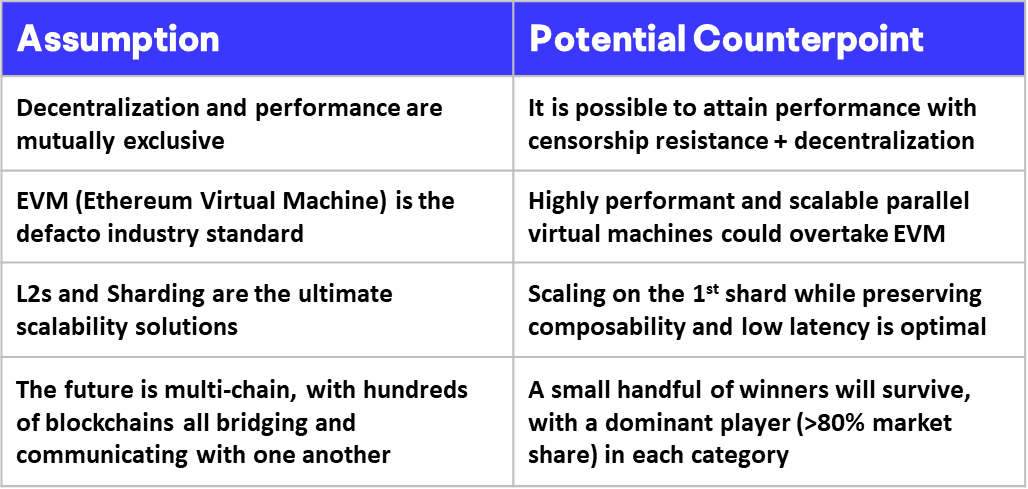

The crypto space is currently ‘governed’ by a set of narratives and assumptions that we have all heard repeated again and again, some of them summarized on the left hand side of the table below:

What if the blockchain space was accepting a series of flawed assumptions and making erroneous decisions based off them? This would mean a majority of builders and investors are completely offside, and are allocating time and capital to playing the wrong game.

Any new entrant into the blockchain space is bombarded with references to the blockchain trilemma and the idea that decentralization is the most important factor to solve for, and performant blockchains can never be secure by definition. This is an incredibly warped view that leads the industry down a dangerous path of rejecting innovation and continuing to view early blockchain tradeoffs as absolute truth.

What if these ideas are being perpetuated by participants and investors that are so blinded by their bias and worldview that they refuse to accept the facts as they stand in front of them? What if the preferences of early crypto adopters are no longer in line with those of Web2 users that would be the majority of mass adopters.

If parallel processing virtual machines enable a new era in execution environments, unlock localized fee markets (as opposed to global), and an entire host of other innovations have been made in consensus, data propagation and storage, why do we continue to accept outdated assumptions as the sole truth? We are in a new paradigm of blockchain performance, and the market will gradually adapt to this new information.

We challenge many of these legacy assumptions, and have written extensively already to disprove them, covering decentralization vs. censorship resistance, data propagation, layer 2s, and even the kind of fresh innovation needed to take Web3 experiences to billions.

Legacy technology and assumptions will not enable the Web2-like experience required to reach mass adoption

When the crypto space is viewed through the lens of mass adoption, it becomes clear that the only way we are going to onboard hundreds of millions or billions of users is by offering Web2-like user experience combined with application innovations that are uniquely enabled by Web3 native technology and ideation.

The features and properties of next generation blockchains like Solana with high throughput, minimal fees, low latency, and large scalability enable applications with Web2-like UX and global impact to be developed.

If a Web2 seamless user experience is what is required, why do we continue to repeat narratives, like Ethereum’s limited TPS and prolonged finality times (13 TPS at 12 second interval blocks) will be enough to power the “world computer” and the “future of finance”? These narratives have gotten to truly ridiculous heights.

Why don’t we dismantle each and every single one of these assumptions? For instance, the fact that virtually all modern hardware is multi-core, and the Ethereum Virtual Machine (EVM) is single threaded meaning it does not make use of multi-core hardware making it is woefully bad in comparison with parallel processing VMs. Simply put, a sequential processing virtual machine is strictly worse, and cannot compete in a multi-core hardware world. Why would we accept global fee markets when newer chains employ localized fees? There is no reason why a hyped NFT mint should ever affect a swap or DeFi transaction! Being able to assign fees per contract is absolutely essential, and probably a requirement to achieve mass adoption.

Moreover, why should we rely on scaling solutions that break composability and fragment user experience and liquidity? This forces users to use unsafe bridges from one chain to another when there are Next Generation Blockchains that can already handle 1000x more data propagation on the L1 when compared to Ethereum. This means Next Generation Blockchains can scale without needing to make disastrously bad tradeoffs destroying the compounding of innovation so early in their lifecycles. Again, moving all activities across L2s and sharding networks is a strictly worse approach to scaling blockchains in a world where the limits of physics have not been tested at the L1 level. Once L1 performance has reached the upper bound of its physical limitations, then a widespread L2 or sharding solution will be necessitated. Until then, we should continue to push the envelope!

What if a large portion of the industry is playing the wrong game ?

What if a majority of the industry is blinded by the wrong assumptions and beliefs? Kodak couldn’t imagine a world without film photography, and unfortunately, many in the blockchain space can’t imagine a world where their assumptions or beloved trilemma no longer hold. In the coming months and years, it seems likely that deeply held beliefs and frameworks will be drawn into question.

Without playing the right game and solving for the correct tradeoffs, funds and builders will allocate their resources to the wrong technologies. Unfortunately, many dApps and protocols have achieved some level of product market fit but on chains with very poor scalability. Many of these projects and companies could end up being the champions of dial-up and broadband markets when fiber optic exists. Next generation blockchains continue to scale with improvements in hardware and bandwidth, and it will be very difficult for legacy chains to compete on performance.

We believe some of the core innovations that have already been developed and implemented by next generation blockchains like Solana have already changed the path of the industry. This trend is only set to accelerate as the scalability and advantages of the design choices become more evident, and as applications that can’t be built elsewhere begin to amass millions of users.

We need to challenge our assumptions daily. Nothing is promised, and technology is a moving target, the immense opportunity of investing in emergent technologies also comes with massive risks, especially for those who fail to update their thesis real time with new information. We have a clear approach to sail these waters but suspect the next years will be extremely telling. Innovation stops for no one and those who refuse to acknowledge it and implement it will be competed away by those who do.