We find ourselves in a transitionary era of finance. On the one hand, cryptocurrencies allow a billion dollars of value to be transferred in under a second for less than a cent. However, most consumers are blind to these technological advancements, do not yet benefit from them, and utilize slow, costly, industrial-era rails. In order to transition our existing finance system from the industrial age to the Internet era, the need has never been as clear for next-generation institutions that implement leading edge practices from crypto to deliver a 100x better user experience. What would such a next-generation financial institution enable?

Put simply, the financial institutions of tomorrow should grant anyone the ability to trade everything, borrow, earn, transact, and custody their assets freely:

- Deposit any asset (digital or traditional) and automatically earn strong interest-yield

- Trade any asset 24/7, 365 days a year (spot or leverage) in a capital-efficient manner

- Send and receive value (e.g., stablecoins) instantly, not in days

- Pay for anything (debt or credit) from a single account for all assets

- Publicly verify that assets are backed on a 1:1 basis rather than via fractional reserves

- Withdraw assets (digital or traditional) at any time without the risk of a bank run

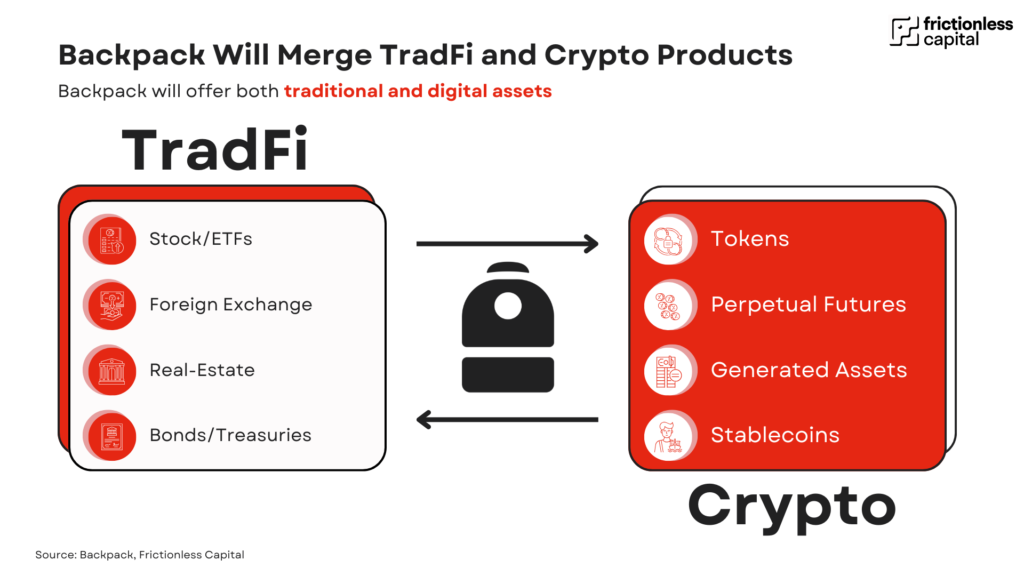

This is the future that Backpack is building. The promise of crypto and open finance is to not only democratize finance, but to create a better and more transparent system for capital market participants globally. This entails using crypto technology like smart contracts and stablecoins to grant users around the world access to products that have historically been available primarily in U.S. capital markets, such as dollarized savings accounts, equities markets, commodities, and even tokenized real estate and fixed income products.

Crypto is eating traditional finance, in the same way that software is eating the world.

Widespread cross-pollination is now emerging between traditional financial products and crypto-native services, with exchanges at the forefront as the connective tissue linking these two parallel systems. Over time their distinctions will blur, giving rise to a new financial system. In this way, “crypto finance” will move into the zeitgeist to become just “finance”, in the same way that “internet technology companies” became just “tech”. Backpack is positioning itself as the connective tissue between the traditional and on-chain economies, bringing together critical products from each side. By shifting capital markets onto internet era financial rails, trade settlement collapses from T+2 days to T+200ms (milliseconds), allowing real-world assets and instruments to trade more efficiently (as crypto assets) than ever before. As Larry Fink, CEO of Blackrock, has noted, “the next generation for markets and next generation for securities will be tokenization of securities” (New York Times DealBook event, 2022).1 In a world where everything will be tokenized, and trades 24/7 on crypto rails, the opportunity to rebuild finance has never been more clear. It is naive and unrealistic to assume that 100+ year old institutions will tear down their existing platforms to build from the ground up using these emergent technologies, in fact they have already had decades to do so.

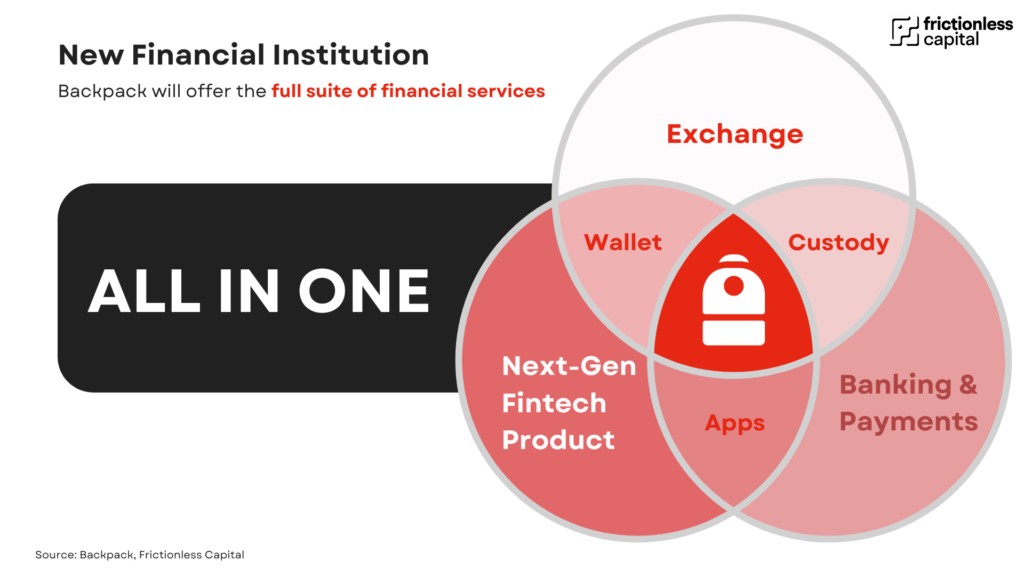

To address this emergent frontier of finance, new financial institutions must combine leading crypto technical know-how with risk, legal, and compliance expertise. Historically, successful crypto companies have innovated on the crypto native product front but have lacked the sophistication to navigate the global compliance landscape. This resulted in platforms that were well-loved by traders but left much to be desired in terms of risk management, licensing, and operations. Backpack is combining all the pieces together to build a next generation financial institution from the ground up. At its endstate, Backpack will not just be a place to trade; it will be the central hub for all assets and the first institution of its kind, worldwide. Since its inception, the crypto industry has recreated parts of the traditional finance system, but has not yet connected the dots between products to create a seamless, integrated, and fully compliant product. This is the approach that is required to transcend the crypto sphere and displace traditional financial institutions with a uniquely better product.

In the early days of the crypto industry, entrepreneurs experimented with standalone “products” such as wallets, exchanges, and decentralized borrow-lend markets. However, to bring crypto and open finance innovations to the next billion users, we must recognize that these fragmented “products” are really features within larger applications. In this way, Backpack is not just a wallet or exchange, but rather an all encompassing suite of applications that are fully integrated into what we are calling “the Backpack experience”. Backpack will enable users to download a single application that will allow them to custody any asset, trade freely, transact with merchants, and interact with on-chain applications.

Wallet, Exchange, Bank, or Global Fintech Application?

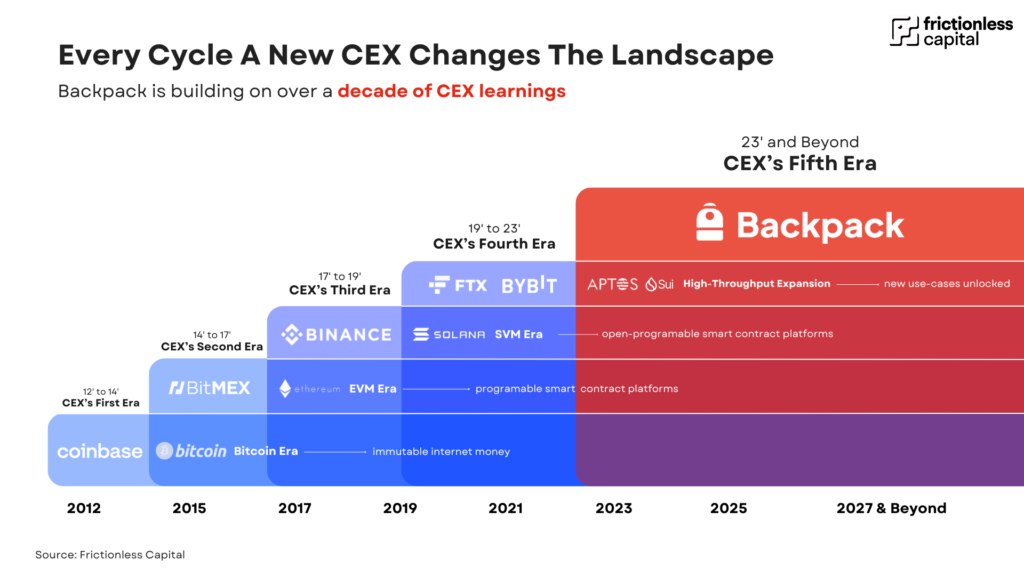

An exchange is the foundational platform at the heart of Backpack. With an exchange you can custody assets, enabling trading, and offer licensed connectivity to fiat (banking) rails. Each cycle introduces a new generation of centralized exchanges. We believe that Backpack has internalized key lessons from its predecessors, assembled the right team and is now rapidly advancing toward its end-state as the “everything finance app”. It is rapidly building an extremely performant platform from the ground up, avoiding the shortcomings of previous exchanges.

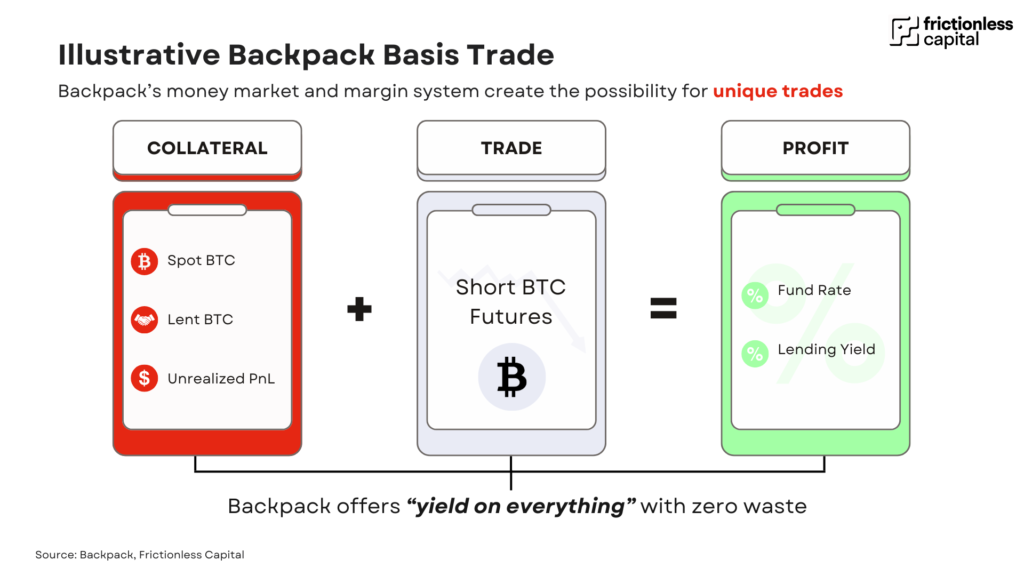

Backpack builds on this basic functionality to include a best-in-class borrow-lend money market natively in the exchange. Global credit and capital efficiency are essential to markets, and Backpack will offer this service to traders, particularly institutional clients who are unable to trade on no-KYC onchain venues because of the counterparty rule. Backpack’s native money market gives traders the ability to borrow against their assets to trade, or to withdraw to a different blockchain network. For those that want to lend out their assets to generate additional yield, this process happens automatically, all from a single exchange account. This is a vastly improved UX relative to legacy exchanges that require multiple additional steps to perform the same action. Where many exchanges bolt on an “earn” product onto their website, on Backpack the borrow-lend is a central part of the margin system. This allows users to automatically earn yield on deposits like USDC, unrealized PnL, and lent assets.

On Backpack, you will be able to borrow any asset and withdraw to another chain, similar to Aave, yet spanning multiple networks under one margin system. More significantly, lent assets count as collateral, allowing you to earn lending yield while trading against a position or utilizing it to earn additional yield from delta neutral strategies. A clear example of the power of this is Backpack’s leading basis trade, which offers superior yield and capital efficiency relative to other exchanges.

Backpack offers the most capital efficient basis trade in the industry.

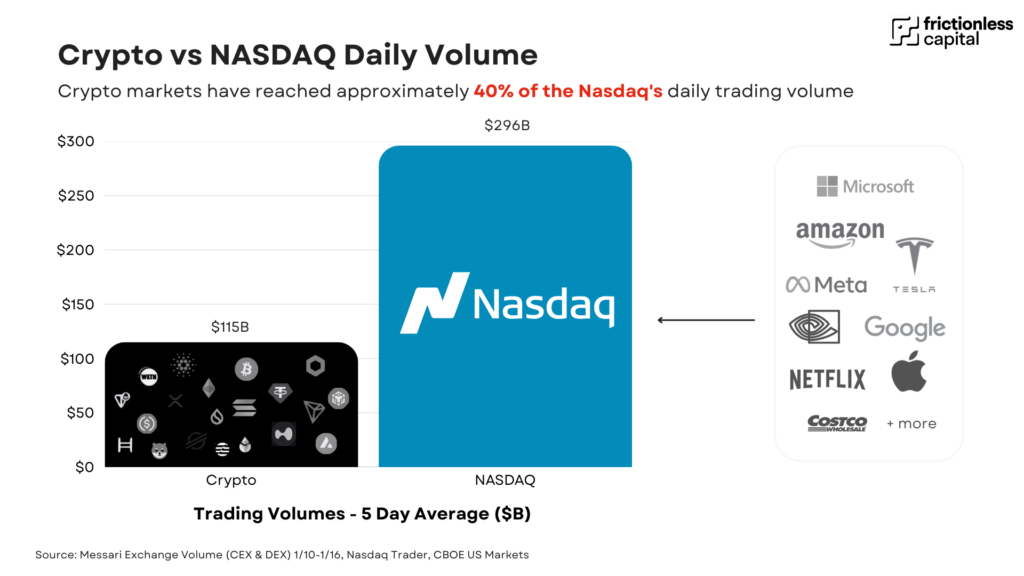

Centralized Exchanges (CEXs) are crypto’s most profitable product alongside stablecoins. In addition to having the most users, exchanges are indisputably among the most profitable businesses in the industry. CEXs have generated ~$50 billion in profit in the past 10 years, routinely capturing 80%+ profit margins on revenue derived from the trading of crypto assets. Every day, well over $100 billion worth of crypto futures alone are traded (excluding spot trading volumes). To give readers a sense of the magnitude of these numbers, this is approximately 30x larger than the daily trading volumes of Tesla, NVIDIA, Apple, Microsoft, and Amazon combined.

These metrics are expected to grow dramatically over the next decade. Despite being crypto’s favorite product, current players are not addressing the full scope of internet capital markets, creating a clear opportunity for a new entrant to address the entire financial stack.

For millions of people around the world, their CEX represents more than simply a place to trade, but also a digital bank account of sorts, to manage their finances, access digital dollars, make payments, and also to avoid stringent capital controls. Centralized exchanges also crucially serve as the connective link between fiat on traditional financial rails and the booming on-chain economy. This role as fiat-crypto on-off ramp is a critical one, and a market which moves hundreds of billions of dollars per year. In this article we will outline some of the nuances of the CEX space and why we believe Backpack Exchange is unlike any other CEX in the world, and uniquely positioned to capture a large piece of the market and redefine the way people interact with their assets.

The opportunity to create a new global financial institution for the crypto era is astoundingly large. In 2024, during its trading preseason, Backpack Exchange showcased $60 billion in fee-paying spot volumes, which was 44% of Robinhood over the same period.

This is an early indication of the power of crypto serving the entire global capital markets relative to just a single region. Crypto is on the path to displace established finance players globally, in the same way Internet companies replaced brick and mortar.

Access to Global Markets is Key: Licenses Matter

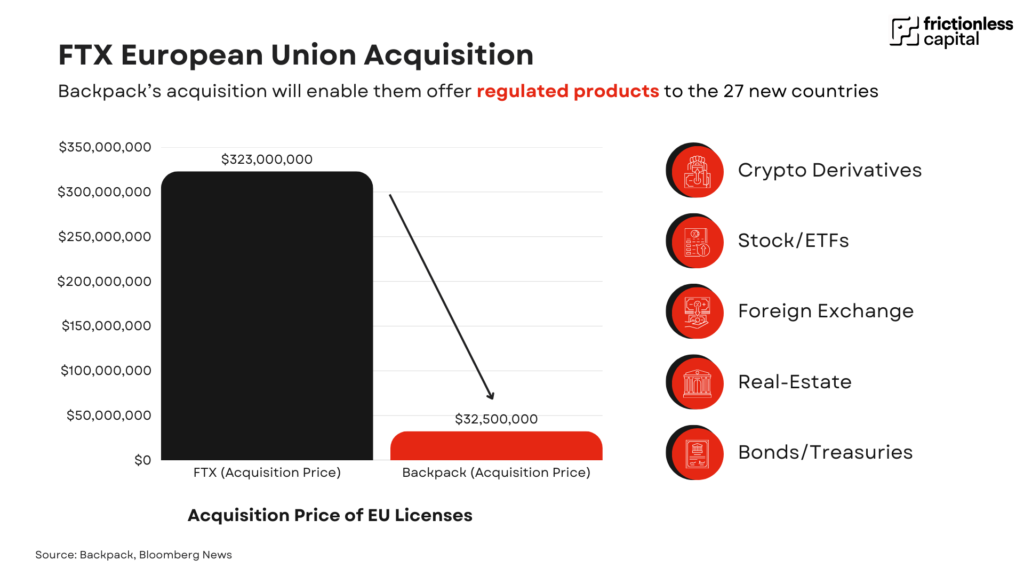

In order to achieve mainstream retail adoption, crypto exchanges must offer a stellar product complete with banking ramps to users. Assuming that users already have native crypto assets and know how to trade on the blockchain severely restricts the addressable universe of potential users. In order to market directly and offer ramps, CEXs must obtain and comply with an increasing number of country specific retail trading licenses which can be extremely costly and time-consuming to obtain. For context, in order to reach a dominant position in the market, FTX spent over $500m on its licenses to serve the majority of the world’s GDP. Backpack is expected to reach a comparable level of licensing by Q2-Q3 of 2025 for less than 10% of the cost.

On January 7th, Backpack announced the acquisition of FTX EU for $32.7 million, securing a significant foothold in Europe where users generally constitute 20-30% of global crypto volumes. FTX’s former European clientele generated >$200m a year in revenue at a time when OKX, Binance, and ByBit were all strong competitors in the European market. Today, these exchanges have left this market, presenting Backpack with a new opportunity to bring popular products to Europe.

Crucially, the transfer of FTX EU’s MiFID II license to Backpack will likely allow Backpack Exchange to stake its position as a leading provider of crypto derivatives products (which constitute a large majority of global crypto trading volumes) to retail users in all 27 EU member countries. For ease of use, Backpack will integrate traditional payment systems, allowing users to conduct SEPA and wire transfers throughout Europe. Furthermore, the MiFID license is the same one held by traditional banking players, enabling Backpack to serve equities, fixed income, and tokenized securities in the future.

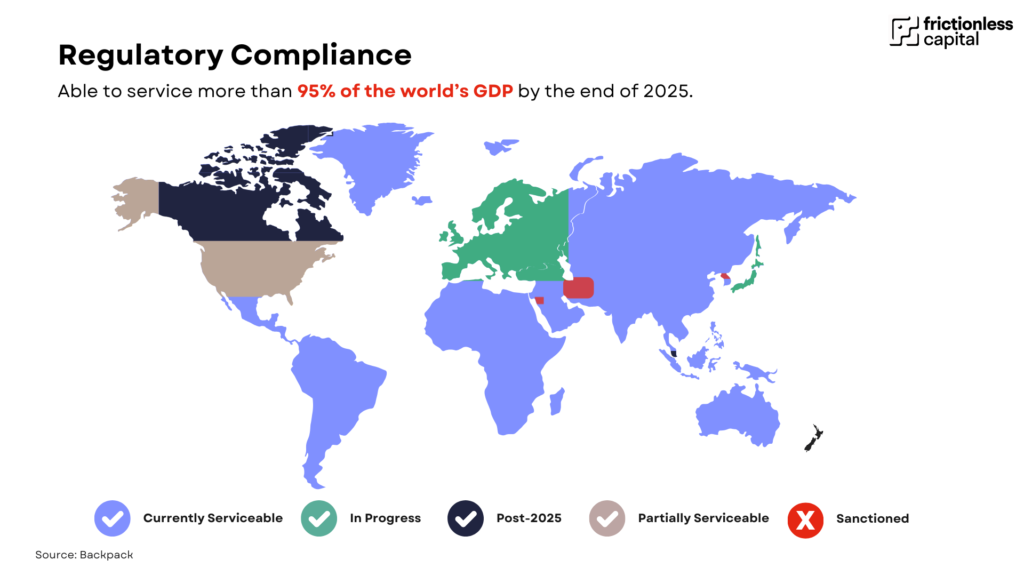

The FTX EU business acquisition is just one of the notable achievements on the regulatory front for Backpack Exchange. In November 2024, Backpack became a member of Japan’s self-regulatory organization for crypto exchanges, the Japan Virtual and Crypto Asset Exchange Association (JVCEA) making them the first crypto exchange to do so since Binance over two years ago. This represents one of the key steps to obtaining licensing in Japan. In 2023, Backpack became the first operational cryptocurrency exchange to receive the full markets license by the Dubai Virtual Assets Regulatory Authority. The company is also licensed in Australia, able to conduct cryptoasset related marketing in the United Kingdom, and on the path to extend its US coverage to all 50 States (currently 12) in the future.

Backpack has rapidly positioned itself as a global force in crypto compliance, even relative to established industry players. The ability to rapidly expand its regulatory footprint will extend Backpack’s ability to distribute its product, resulting in a significant regulatory moat as crypto regulations tighten, and are applied across incumbents. By the end of 2025, Backpack will have joined a very small group of exchanges able to compliantly serve customers in over 95% of the world’s GDP, allowing the company to bring its products to hundreds of millions of users.

A New Product Paradigm

Alongside its new margin system, the team has designed a market leading risk management system which is reliable, robust, and transparent. This risk management system continuously evaluates portfolio health, dynamically adjusting margin and liquidation parameters in times of volatility.

Backpack’s account system also greatly simplifies the deposit flow, eliminating the need to transfer from a spot account to derivatives account, allowing traders to place futures trades directly from the account they deposit to. The benefits of this approach to the product are immediately evident to the exchange power user and will position Backpack as a superior trading venue.

By utilizing leading edge account abstraction and cryptography practices, Backpack has made enormous strides on the custody front to develop the most advanced custody solution on the market. Backpack has created a “safe” product with Squads which allows traders to sweep assets into a multisig wallet which offers self-custody but is also recoverable if a user misplaces or loses their private keys.

This wallet is embedded into the Backpack Exchange and allows users to withdraw their funds regardless of the situation, completely eliminating the possibility for users to have funds stuck on the Exchange with no ability to withdraw. By using challenge response times similar to techniques used by L2s, Backpack Exchange is able to regenerate a user’s lost keys after verifying their identity. This means that by transferring their assets to their safe, Backpack is able to offer users self-custody and total autonomy over their assets while offering recoverability and the user experience of a centralized exchange.

This breakthrough will help mitigate the billions of dollars of crypto assets that are lost every year from self custody. Historically, once private keys such as seed phrases are misplaced, the assets are lost forever, and improper private key management remains one of the most significant blockers for widespread ownership and adoption of digital assets.

Market Backdrop

The Centralized Exchange (CEX) landscape has shifted significantly since 2021, characterized by the collapse of FTX which left a large hole in the market not only in terms of market share but also in terms of product, being the only CEX to adopt a cross-collateral first approach. FTX underscored the need for a fully regulated and compliant exchange with a transparent and dynamic risk model, with publicly verifiable proof of reserves. It also highlighted the need for self-custody and the ability for traders to withdraw their assets from an exchange in times of extreme volatility and uncertainty. Amidst these shifts and demands from the market, we note that Backpack is the only new entrant in the CEX space in recent times that has been able to stand up an exchange incorporating these features and obtain the relevant licenses to be able to legally operate in a large portion of the global market.

On the compliance and legal front, several major exchanges such as Binance, ByBit, and OKX have been forced to exit parts of Europe.

As ByBit CEO Ben Zhou observed in September 2024, “There will be a bloodbath as all of the top exchanges will pull out of Europe, particularly for derivatives” (Weixin Interview, September 2024). During this same period, decentralized exchanges (DEXs) have gained traction, with the DEX/CEX volume ratio surpassing 15% for the first time in early 2025.

Another important trend is the pushback from companies against established exchange players who routinely demand 5%-15% of token supply in order to be listed on a Tier-1 exchange, often accompanied by changes to token vesting in order to allow the CEX to divest those tokens prior to the team or key employees vesting. Furthermore, traders are expressing a strong desire to have access to purchase tokens at earlier times in the life cycle, as the price performance of token listings following listing on T-1 CEXs is often overwhelmingly negative, especially for low-float, projects at multi-billion fully diluted valuations.

As the market grows wary of opaque exchanges particularly those relying on internal market makers to profit from user trades, transparency around reserves and solvency has become paramount. Backpack alone stands out as a fully transparent and compliant exchange since inception.

Putting the Pieces Together

Backpack is on the path to transcend the traditional CEX product to become a next generation financial institution. Their innovative product and distribution advantage granted by their global licensing footprint results in a platform where the total is greater than the sum of the parts. The only other exchanges with comparable distribution and regulatory coverage are valued in the tens or hundreds of billions of dollars. In the coming months as the product is rolled out to tens of millions of traders, the design choices of the team and their deep compliance expertise will be evidenced. Perhaps the most important takeaway for readers from this piece is that Backpack is not building a better crypto institution, but a better financial institution period.